EUROPEAN MARKET

1.1 Current situation 42 weeks

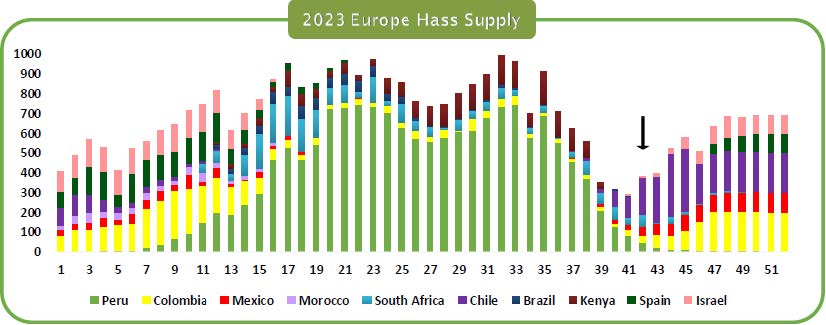

During this week the supply of Hass avocado remained low. Peru, Kenya and South Africa are getting closer to the end of the season. So much so, that this week 46 containers were received from Peru and 60 from South Africa. According to Juan Carlos Paredes, president of the association of Hass avocado producers and exporters of Peru, exports during this season totaled 570,000 tons, a figure similar to that registered in 2022 and 50,000 tons less than the 620,000 tons initially projected.

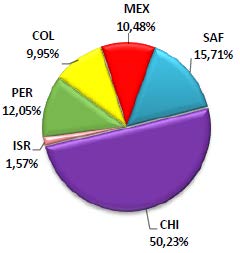

On the other hand, The Origins of Winter are evolving slowly, although they tend to reach a medium level. Chilean arrivals have increased to 192 containers and are expected to continue increasing gradually. In the same way, Colombia has been increasing its arrivals, however, it is a low volume for the moment, with only 38 containers for this week, in addition its caliber curve is focused mainly on medium and small. Israel's loads also remain low, labor at this time is limited due to the conflicts that have been occurring, therefore, harvesting and packaging is difficult. For now their shipments will only concentrate on green skin. Morocco, on the other hand, is bringing forward its season to enter the market with much earlier fruit, however, this has not made it possible to compensate for the lack of fruit. Like Colombia, Mexican shipments are recorded with 40 containers per week, but during week 42 the volume harvested was lower, due to the weather conditions that were occurring.

According to this panorama, the size curve in the European market is becoming increasingly difficult,

Due to the high supply of medium and small sizes, and the low supply of large size fruit, Morocco and Israel are expected to be those suppliers that can supply this larger fruit in the course of the following weeks.

As for demand, this has been moderate but constant in retail programs, where

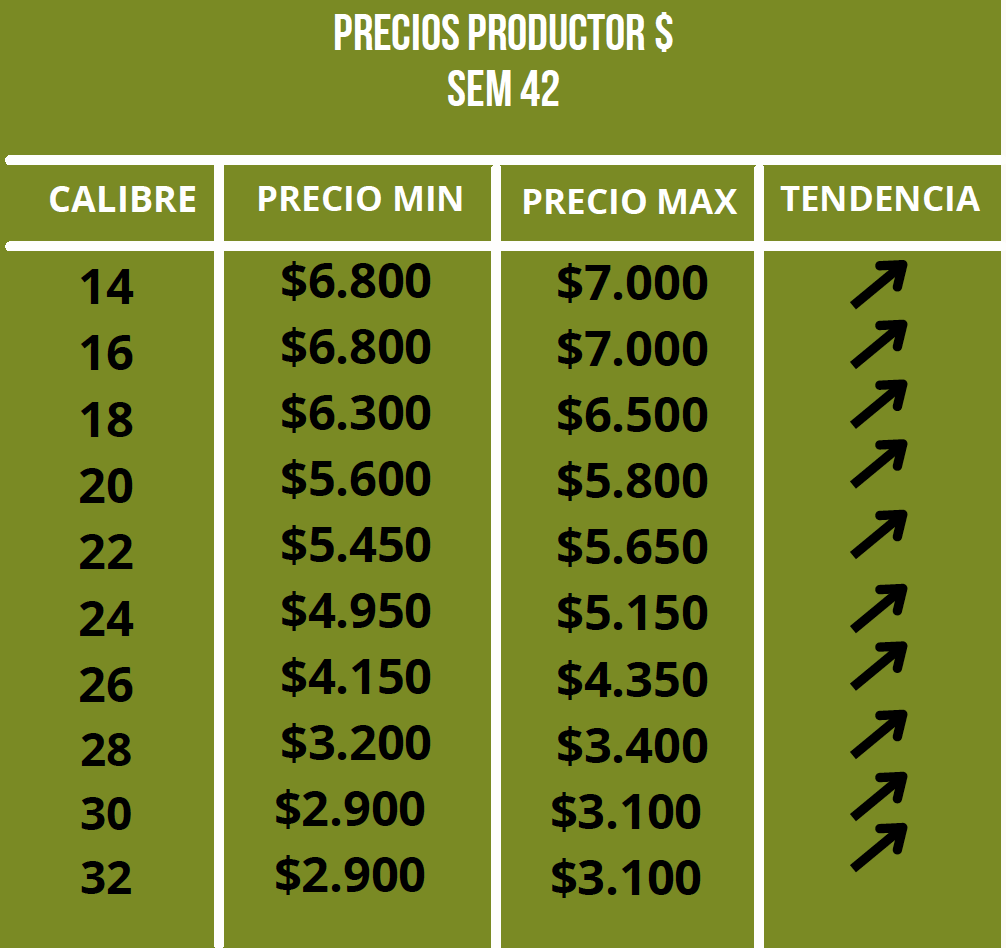

Prices have remained below the quoted price range. While in the spot market, due to low availability, tensions have been increasing as have prices, reaching a level higher than the market price range.

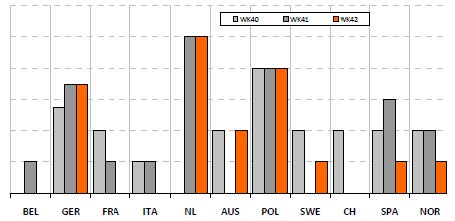

Graph 1. Advertising intensity per week and countries. Source: Global Market Report

Graph 2. Suppliers in the European market during week 42

Source: www.fruitrop.com

1.3 forecast

The gradual increase in supply expected in the coming weeks will help alleviate tensions in the European market. Chile will double its volume and will quickly enter between 229 containers to 321 containers. Likewise, Morocco is expected to gradually increase its volume, trying to compensate for the slow start of winter origins. However, it is possible that there is a dispersion in the dry matter, since some batches may be below what is required. On Israel's side, the situation remains uncertain and export capacity may remain limited for the time being.

As for prices, these have remained at good levels during the month of October, however, a reduction is expected in the month of November, due to the wide availability of medium and small fruit, and the increase in supply from from Chile and Morocco. In the longer term, for the holiday season there may be a slight reduction in demand, due to school holidays and the winter season, which may slow down consumption.

fruit volume Europe 2023

producer prices europe

The market report is settled at the rate of the referring week

"The prices represented here are an estimate and should not be interpreted as definitive values to be paid."

US market

2.1 current situation

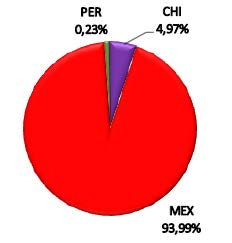

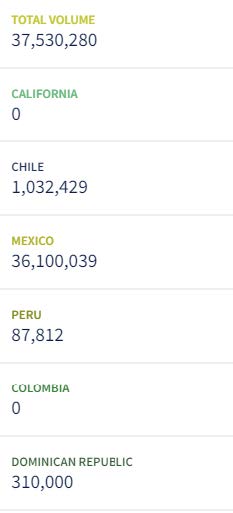

During week 41, statistics showed a limited volume of fruit in the US market, with the end of the season in California and Peru, Mexico is positioned as the main supplier with a market share of 93% with 36,100,039 Lbs. However, Chile is also making its way into the market, although with a smaller volume of 1,910,000 Lbs. Because supply is limited and 21% has fallen below average, prices have begun to increase little by little.

Graph 3. Suppliers in the US market during week 42

Source: www.fruitrop.com

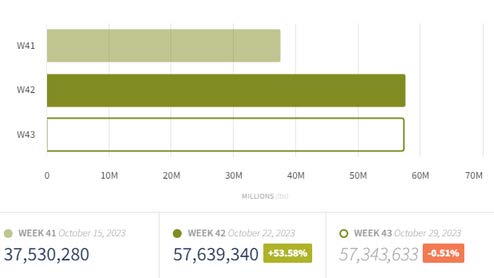

Graph 4. Weekly fruit volume

Source: Hass Avocado Board

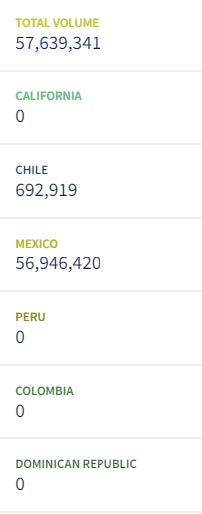

Note: keep in mind that the values for week 42 and 43 are estimates, they are not yet real data.

2.1 statistics

volume of fruit sold wk 41 updated

SEM ESTIMATES 42

PRESENT

3.1 NEWS

Colombian avocado strategies in the North American market

The Hass avocado is one of the most profitable crops today and several countries have been joining this industry.

In fact, Colombia hopes to become the second largest producer in the world by 2040, if achieved, it would surpass Chile and Peru, countries that lead the industry in South America.

According to Dr. Manuel Michel, Executive Director of the Colombia Avocado Board, “the good taste and texture of avocado are necessary to be in business. So you need to have good quality fruit that meets the buyer's expectations."

“In addition, we see that an important competitive advantage in the case of Colombia is the fact that our avocados come from one of the countries with the greatest biodiversity in the world and with a high focus on sustainability. Due to Colombia's tropical yet temperate climate, they receive a high level of annual rainfall and Colombian avocados are naturally watered by Mother Nature without relying on irrigation from underground water resources. At the same time, many of Colombia's avocado producers have helped protect and restore areas of natural ecosystems,” he emphasizes.

He adds that “finally, Colombia's location near key ports allows for fast and easy shipments to East Coast markets, which can reach Florida in 2 to 3 days, and to Philadelphia and New York in 4 to 5 days ”.

Promotion, dissemination and sustainability.

Regarding promotional strategies for Colombian avocado, Dr. Manuel Michel points out that “our objective during the last 18 months has been for buyers to know and know that Colombian avocado is available for import. Both their availability during the year, the projected volume, where and how they are grown, and the competitive advantages, as well as the ease of shipping and the sustainable nature.”

“It is important that buyers know the history and human side of the Colombian avocado. The pride that the Colombian people have in being global suppliers of a crop in high demand. Many avocado-producing regions were conflict regions that are now developing economic opportunities thanks to the avocado industry,” he adds.

He also adds that the idea is to provide support and information to buyers.

“We are available to work with retailers and foodservice buyers to customize promotions that best fit their needs and sales goals. As the volume of Colombian avocado in the US increases, you can expect to see more exclusive market-based programs that highlight the culture of Colombia

over the next 12 months. “All Colombian avocados that reach the US market find a market.”

Bibliography

Fruit Portal (October 25, 2023). PortalFrutícola.com Obtained fromhttps://www.portalfruticola.com/noticias/2023/10/25/estrategias-del-aguacate-colombiano-para-el-mercado-de-ee-uu/